The debt avalanche strategy is a method you can use to pay off outstanding debt. With this strategy, you focus on paying off balances with the highest interest rate first.

In this blog, we will have a closer look at the debt avalanche method, how it works, how you can improve your chances of success and any potential benefits and drawbacks of it.

How does the debt avalanche method work?

When multiple credit card debts or loans build up, it can feel overwhelming, especially when faced with high interest rates.

By targeting debt with the highest interest rate first, you can get rid of the loan that could cost you the most over time. This may help you save more money over the lifetime of your debts.

Here’s how it works:

- Assess your financial situation and look at how much interest is applied to each of your outstanding debts.

- Prioritise the debts in terms of the interest rates, the highest rate coming first, and the lowest coming last.

- Pay the minimum amount on all loans. If you are able to, contribute any spare money to pay off the highest interest loan.

- Once this has been paid off, put the amount you were paying every month towards the next debt on your list.

- Continue this process until you have paid off all of your debts.

It's essential to remember that repaying a debt ahead of schedule could result in encountering an early repayment fee, potentially adding to your expenses. Therefore, it's crucial to take this into account before making any additional payments.

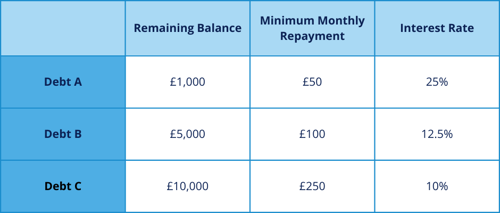

Here’s an example of this method in action:

In this case, your primary focus would be on Debt A, because it carries the highest interest rate.

Let's assume you have an extra £100 per month that you can allocate toward your monthly repayments. You would begin by directing £150 per month towards Debt A. This is the minimum amount you need to pay plus your extra payment.

Once this debt is completely paid off, you’d roll that £150 onto the debt with the second-highest interest rate. In this case, it would be Debt B, increasing your repayments on this debt to £250.

The same process will be followed until all the debts have been cleared. By following this method, you may be able to speed up the rate you repay your loans and reduce the amount of interest paid.

How to improve your chances of success

As with any financial strategy, you must familiarise yourself with your finances. Figure out exactly how much you owe to each creditor, how much the interest is, and the minimum amounts you need to repay each month.

Also, you should make sure you have a strong monthly budget. Taking steps to budget effectively will allow you to see if you have any money left over at the end of the month to contribute towards paying down your debt. Remember, even a small amount can make a huge difference.

If you find you have no spare money, try to make an effort towards reducing your outgoings.

To stay motivated, you can find debt avalanche calculators online. Take a look at how long it would take you to pay back your loan with the avalanche method vs without it. You can also see how much money you’d save in interest.

Pros of the debt avalanche method

- It can speed up your repayments – Using the debt avalanche method may help speed up the process of paying off your debt, compared to if you just paid the minimum amounts each month.

- Could lower the amount of interest you pay – You stand a chance to save money, as paying off the debt sooner shortens the term, meaning you will accrue interest for a shorter period of time.

Cons of the debt avalanche method

- You need to stay committed – While the method may help you speed up repayments, it requires you to remain disciplined for a long time. Making sure you set aside extra money to help pay off debt can be difficult, so you need to find a way to stay motivated.

- May not work in emergencies – Sometimes, unforeseen circumstances arise, where you may need to redirect your funds. The avalanche method requires a consistent approach, but when emergencies occur, you may have to stop using the method to pay for something else.

Are there alternative approaches to settling debt?

One option worth considering is debt consolidation, which involves taking out a new loan to pay off all your existing debts. This combines them into a single monthly payment, simplifying your finances. To pursue this, you can explore debt consolidation loans, which are designed for this purpose. However, it's important to note that while this method can be helpful, it may extend the terms of the debt and result in a higher total repayment amount.

Additionally, there are other ways to address outstanding balances. One other strategy is the debt snowball method, which prioritises paying off smaller balances first. While similar to the avalanche method, the focus here is on smaller balances rather than prioritising debts with higher interest rates.

If you're experiencing difficulties meeting your debt obligations, it's advisable to reach out to your current lenders or creditors for assistance. They might be able to provide an alternative repayment arrangement, potentially steering you toward a more manageable path without requiring a loan. You can do this directly or through a debt charity. If you would like extra support or help, reach out to MoneyHelper or Citizens Advice Bureau (CAB).

Summary

The debt avalanche strategy is a method, which can help you pay off your debts by focusing on those with higher interest rates first.

This approach requires understanding your finances, creating a budget, and staying motivated. It can give you better control over your finances and speed up debt repayment. However, staying committed for the long term is essential, and it may not work well in emergencies. Ultimately, the most suitable approach is the one that aligns with your specific needs.

Think carefully before securing other debts against your home. Your home may be repossessed if you do not keep up repayments on a mortgage or any other debt secured on it.